In today’s fast-paced financial environment, professional tax software has emerged as an crucial tool for accountants, businesses, and individuals aiming to reduces costs of their tax processes. Tax laws are notoriously complex, with constant changes and updates that can easily overwhelm even veteran professionals. Professional tax software gives a robust solution by Tax software for tax preparers automated features, accurate computations, and real-time updates on tax regulations. These tools not only ensure complying with legal standards but also improve time management by automating tedious tasks like data entry and report generation. As businesses grow, the requirement for efficient tax solutions becomes critical, making tax software a must-have asset in a professional toolkit.

One of the key features of professional tax software is its capacity to easily simplify intricate tax computations. Built-in algorithms handle complex computations, reducing the risk of human error. This precision is specially beneficial for tax professionals dealing with corporate taxes, reductions, credits, and multi-state filings. Advanced platforms also include scenario planning tools, allowing users to handle different tax strategies before filing. By providing accurate forecasts, these tools encourage businesses to make informed financial decisions, reducing debts and exploiting refunds. In short, the software acts as a virtual assistant, handling the heavy lifting while professionals focus on strategic planning.

Another major benefit from using professional tax software is its complying management capabilities. With ever-changing tax laws, staying updated hand can be a daunting task. Professional tax software addresses this challenge by integrating automatic updates to reflect the latest legal changes. This feature ensures that every tax return conforms with current regulations, eliminating the risk of penalties due to outdated practices. Additionally, these platforms often come with audit support, helping users maintain a clear trek of records to navigate potential assessments or differences with tax authorities with assurance.

Customization is another feature of professional tax software, making it adaptable to various industries and business sizes. From self employed managing self-employment taxes to multinational firms handling intricate tax structures, these tools cater to diverse needs. Custom web templates, industry-specific tax codes, and user-defined settings allow professionals to target the software to their unique requirements. Moreover, integration with other financial tools like accounting software enhances in business efficiency, creating a seamless workflow from income tracking to tax filing.

Security is a the goal for any tax-related operation, and professional tax software does a great job of this type. With sensitive financial data endangered, these platforms employ advanced encryption and multi-factor authentication to shield information. Cloud-based solutions further enhance security by offering secure backups and enabling remote access, ensuring that data is protected from cyber dangers and random loss. For firms handling large amounts of top secret client information, this level of security is non-negotiable, solidifying the software’s position as a trusted resource.

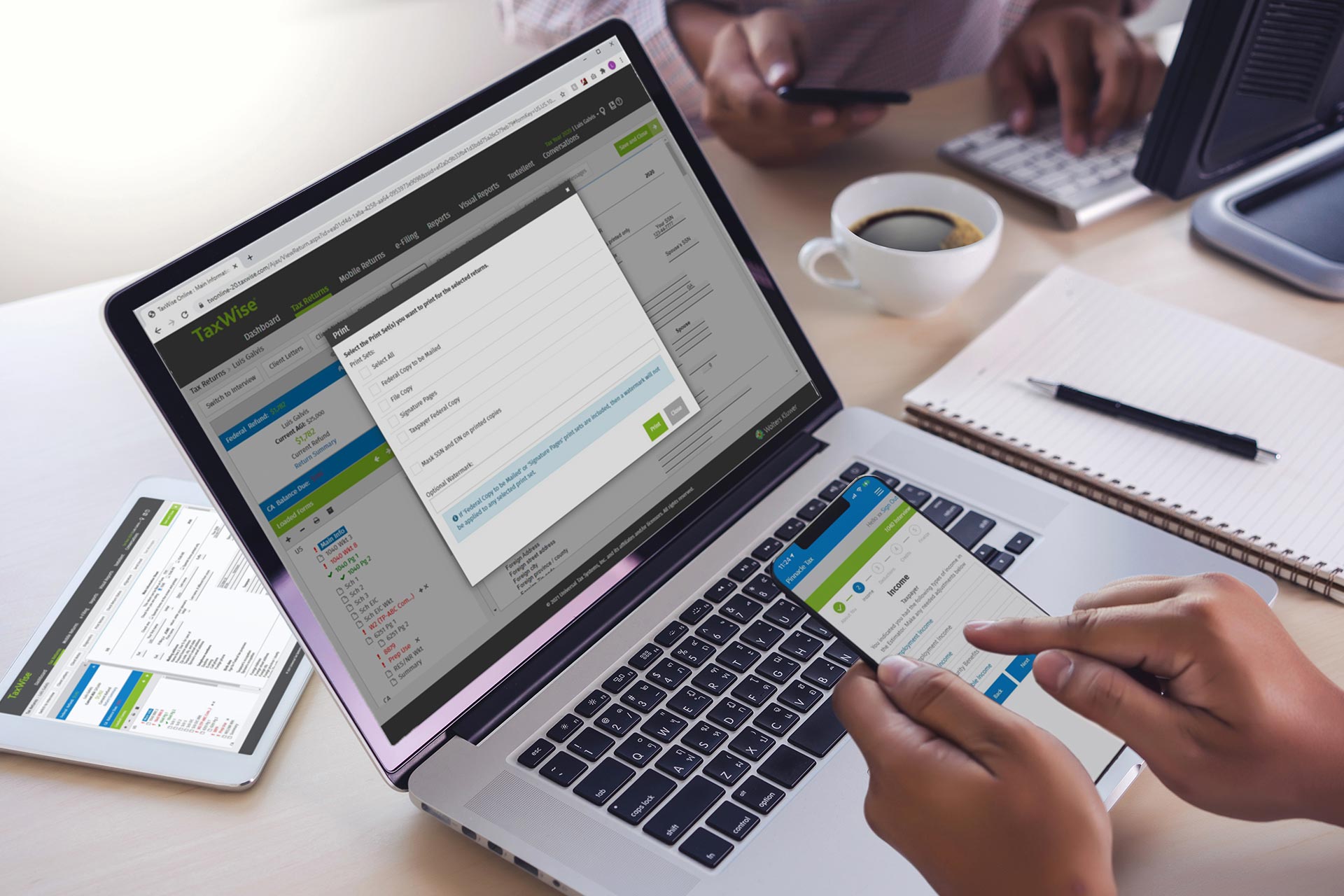

User-friendliness is another reason professional tax software has gained widespread popularity. Developers prioritize intuitive interfaces, enabling even non-technical users to navigate the platform effortlessly. Step-by-step guides, interactive dashboards, and built-in help centers provide users with all the support they need to complete tax tasks efficiently. For professionals new to tax software, many platforms offer extensive training adventures and webinars, ensuring a smooth changeover from manual processes to automated solutions.

Cost-efficiency is a significant benefit, particularly for small and medium-sized businesses. While initial investments in professional tax software may seem high, the long-term savings are substantial. By reducing the time spent on manual tasks and reducing errors, businesses can set aside resources more effectively. Additionally, many software providers offer tiered pricing plans, allowing businesses to select features that line-up with their budgets and requirements. For startups and small firms, this scalability ensures access to professional-grade tools without financial strain.

For tax professionals getting work done in collaborative environments, cloud-based tax software offers absolutely incomparable convenience. Teams can access the platform simultaneously, enabling real-time collaboration on tax projects. This feature is very beneficial during tax season when deadlines are tight, and efficiency is paramount. Cloud-based solutions also facilitate remote work, allowing professionals to manage taxes from any location with an internet connection. This flexibility is invaluable in today’s digital-first business landscape.

As artificial brains (AI) and machine learning continue to change, professional tax software is becoming even more powerful. AI-driven features can analyze vast amounts of financial data, identify patterns, and offer actionable information to improve tax strategies. Machine learning algorithms can also predict potential issues, providing aggressive solutions before they escalate into significant problems. This technological integration is adjusting tax software from a simply tool into an intelligent admin, redefining the number of choices of financial management.

In conclusion, professional tax software is not just one tool; it is a game-changer for folks and businesses navigating the complexity of tax management. By combining accuracy, efficiency, security, and flexibility, these platforms encourage users to tackle tax challenges with full confidence and precision. Whether you’re an impartial accountant, a small business owner, or part of a large corporation, investing in professional tax software can revolutionize your approach to taxes, saving time, reducing stress, and ensuring complying. The future of tax management lies in automation, and taking on professional tax software is the first step towards financial success.